Sustainable Finance Disclosure and Policies

This statement includes mandatory disclosures under Regulation of the European Parliament and of the Council on Sustainability-Related Disclosures in the financial services sector (EU) 2019/2088 (“SFDR”). Access our SFDR statement here.

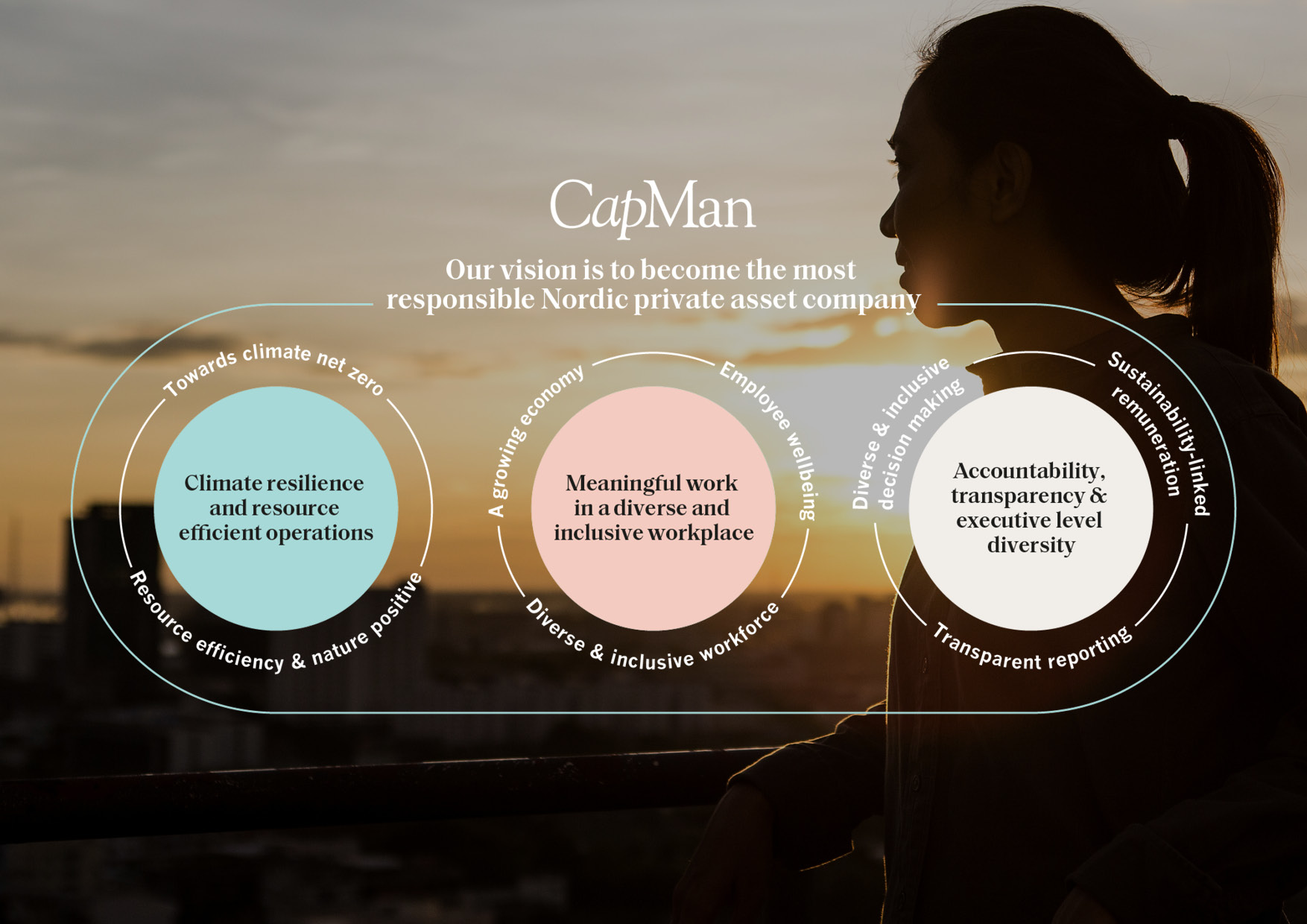

CapMan considers principal adverse impacts of its investment decisions on sustainability factors. The present statement is the consolidated principal adverse sustainability impacts statement of CapMan for the period 1 January to 31 December 2022. Read the full statement below.